Investment Insights - Assessing China

Rusty Hoss, CFA®– DIRECTOR OF EQUITY RESEARCH

Summary

- Over the past decade, Chinese stocks underperformed global peers, including the S&P 500, due to earnings declines and deteriorating levels of profitability.

- China’s economy must work through long-term structural chalenges that include high debt levels associated with a multi-decade property and infrastructure boom, a shrinking labor force due to its ageing population, and the falout from deglobalization.

- Recent efforts by the Chinese government to inject stimulus may offer near-term economic support, however, without resolving the underlying structural chalenges, we remain skeptical that Chinese companies wil generate durable earnings growth that can drive long-term stock price appreciation in excess of other global markets, most notably the U.S.

Chinese stocks have performed poorly over the last decade, underperforming their own emerging markets peers, the S&P 500, and a broader universe of global stocks. In the last ten years, the MSCI China index has returned +0.6% annually versus +6.8% for emerging markets and +12.9% for the S&P 500 (Factset, as of August 31, 2024). Given this level of underperformance, there is a tendency for some to expect the negative performance trend to give way to mean reversion – in other words, for Chinese stocks to outperform the S&P 500 given the valuation differential and a decade of underperformance. We are challenged to buy into this thesis given what we view as significant structural challenges for the Chinese economy. We see three primary constraints:

1. China’s underperformance is well supported by weak corporate fundamentals. In the last ten years, earnings of Chinese companies are down roughly 10% and measures of profitability/capital efficiency such as return on assets, return on equity, and return on capital have deteriorated meaningfully. Meanwhile, earnings for S&P 500 companies have doubled and the same measures of profitability/capital efficiency have improvement.

Bloomberg, Composition Wealth Advisors estimates as of October 1, 2024

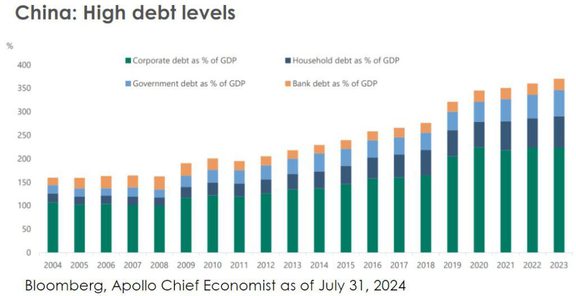

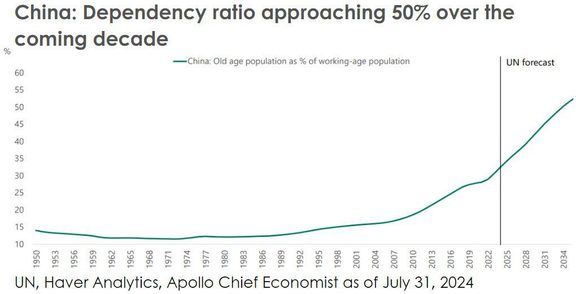

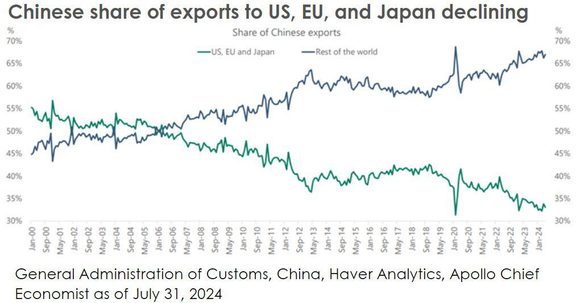

2. China’s economy faces structural challenges that aren’t likely overcome by easier monetary policy or providing consumers with fiscal stimulus. These measures will likely provide relief to the economy and given such negative sentiment and positioning of global investors, stocks are likely to move higher in the short run. However, we see at least three structural headwinds that remain persistent – high levels of debt from a multi-decade property and infrastructure boom, a shrinking labor force due to its aging population, and the fallout from deglobalization.

Bloomberg, Apollo Chief Economist as of July 31, 2024

UN, Haver Analytics, Apollo Chief Economist as of July 31,2024

General Administration of Customs, China, Haver Analytics, Apollo Chief Economist as of July 31, 2024

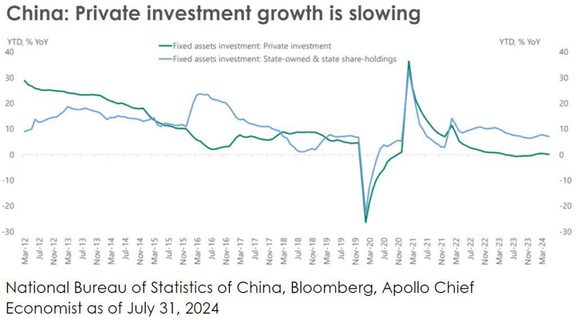

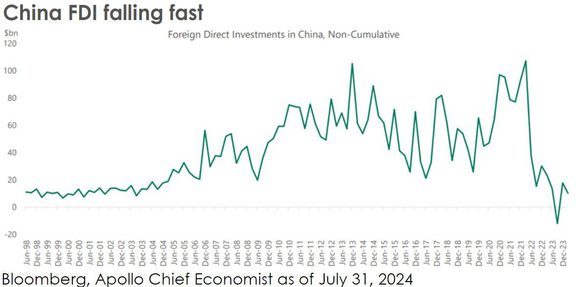

3. Economies that have durable growth (i.e. long-term structural growth) usually have three attributes – entrepreneurship, capital, and an appropriate incentive structure. China has entrepreneurs and capital, but in the last few years, the incentive structure has been distorted by central government policies that are intended to limit the influence of Chinese companies, particularly within the technology sector. As a result, the venture capital/private equity industry – the lifeblood of innovation – is rapidly disappearing. Moreover, foreign direct investment – capital that is invested in a country by foreigners – is also rapidly declining, as capital seeks higher returns in other parts of the world.

National Bureau of Statistics of China, Bloomberg, Apollo Chief Economist as of July 31, 2024

Bloomberg, Apollo Chief Economist as of July 31, 2024

At Miracle Mile Advisors, we believe that stock prices follow earnings growth and that this should hold true regardless of where a stock is domiciled. Of course, there can be extenuating circumstances, like geopolitics, liquidity/accessibility, or highly cyclical economies, that result in unpredictable or volatile earnings. If, however, earnings of public companies are growing consistently over time, stock prices should follow earnings and trend higher. While we acknowledge that lower interest rates, fiscal stimulus, and attractive valuations are likely to support economic activity and Chinese stocks in the short term, we doubt these measures will lead to lasting, durable economic activity that allows Chinese public companies to return to growing earnings leading to appreciably higher stock prices.

Disclosures: Composition Wealth LLC (“Composition”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Composition and its representatives are properly licensed or exempt from licensure. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information is illustrative, provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. Asset Allocation may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. The principal risks of Composition’s strategies are disclosed in the publicly available Form ADV Part 2A. Past performance shown is not indicative of future results, which could differ substantially.